HORIBA regularly publishes news and press releases on corporate information, new products and enhancements, technology advancements, acquisitions, etc. Use the filter function to find news about the HORIBA group of worldwide companies, a particular HORIBA Segment, or HORIBA news in a specific country.

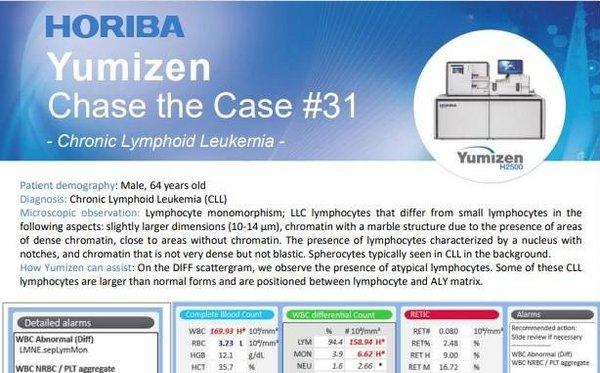

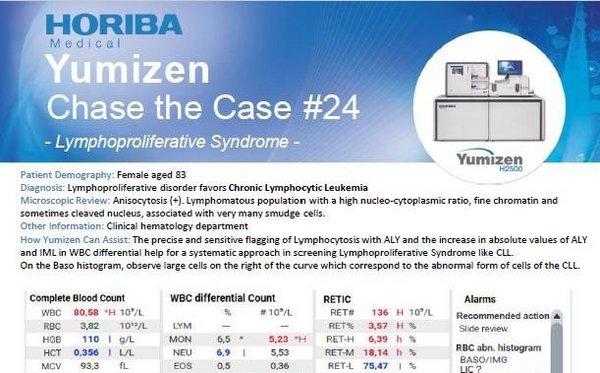

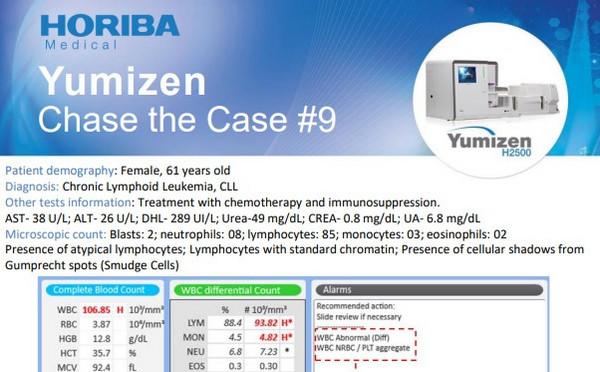

In this issue of Chase the Case, we present a clinical case of Chronic Lymphoid Leukemia (CLL). The diagnosis was supported by the HORIBA Yumizen…

HORIBA Europe's David Schroeck, Global Product Manager Wind Tunnel Technologies, explains what and why a wind tunnel balance is essential...

Launch of HORIBA Group The “Our Future” (Vision, Mission, Values) dedicated website presents the HORIBA Group vision for the world and the kind of…

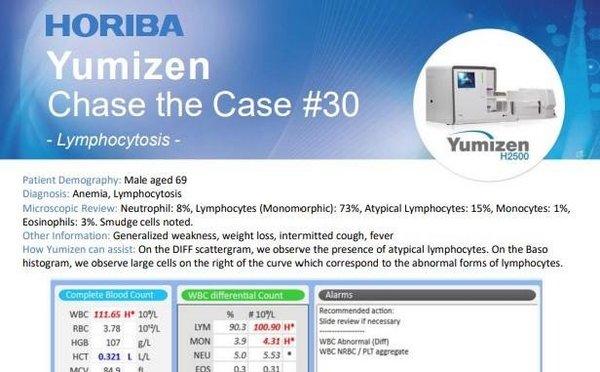

The latest issue of Chase the Case is from a patient diagnosed with Lymphocytosis. See how the hematology analyzer Yumizen H2500 shows the presence of…

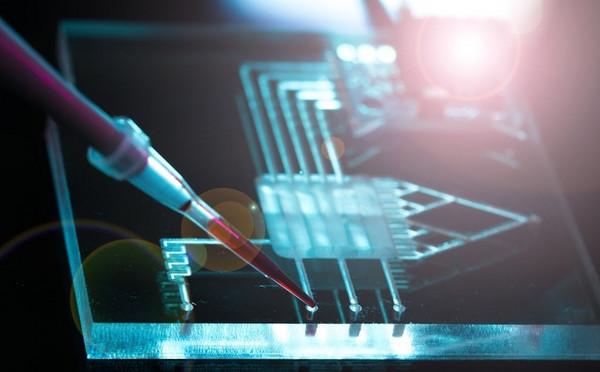

Smart detection and removal of particle contamination using a single system to achieve the utmost efficiency and yield in semiconductor manufacturing…

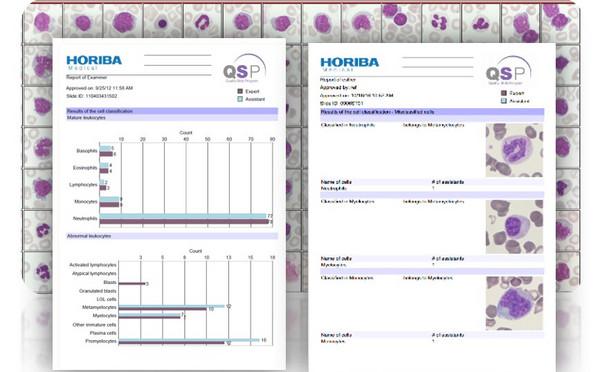

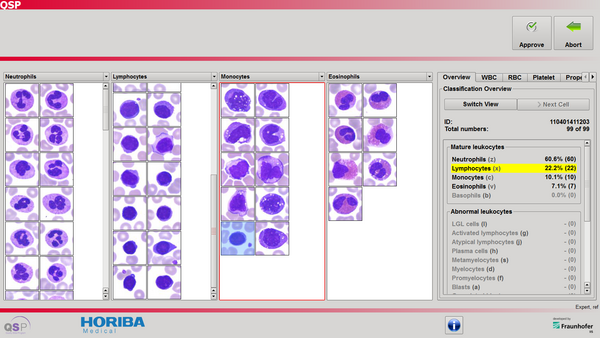

The 44th edition of the QSP Blood Cell Morphology Newsletter features a case study and a quick overview of Nucleated Red Blood Cells (NRBC).

► Read…

HORIBA TECHNO SERVICE Co., Ltd. (hereinafter “HORIBA TECHNO SERVICE”), a Horiba Group company handling analysis/service businesses, joined the…

Let's review last month's blood slide cases in the latest QSP Newsletter, with a focus on AML cases in detail. Additionally, take our monthly cell…

Total immaturity of WBCs is of clinical importance to identify the morphologies and classify infections, inflammations, or hematology…

This year’s theme is ‘Analytical and Measurement Technologies for a Clean Water Environment and Sustainable Society.’

HORIBA Medical is pleased to announce that the company became a member of the French Healthcare Association in January 2024.

The French Healthcare…

HORIBA, Ltd. established “Our Future” (Vision, Mission, Values) for the HORIBA Group on January 26, the anniversary of its foundation.

The HORIBA…

HORIBA, Ltd., a global leader in analytical and measurement technologies, proudly announces the launch of its groundbreaking AP-380 series of…

The 28th Chase the Case features a patient from Brazil who was diagnosed with Myelofibrosis. See how our advanced hematology analyzer, Yumizen H2500,…

This month's edition showcases a case study on an AML patient and the classification of AML. Also, you can test your knowledge with a special…

HORIBA Group’s largest ever investment aims to establish a supply structure with long-term stability

The 27 issue of Chase the Case case diagnosed as Pyropoikilocytosis exhibits significant RBC morphology variability and also emphasizes the utility of…

[Kyoto, Japan] HORIBA, Ltd. is proud to announce that its ADS EVO Automatic Driving System has been selected as the Winner of the German Design Award…

How can we differentiate Chronic Lymphocytic Leukemia (CLL) from other B-Cell Lymphoid Malignancies? The availability of a clinical decision algorithm…

Understanding a rare hematological malignancy like Plasma Cell Leukemia from simple complete blood count (CBC) analysis by utilizing hematology…

In addition to innovative products and services, customers are interested in the values and environmental impact of the companies with whom they…

The 40th issue of the QSP Newsletter features Anemia. You will learn the symptoms, clinical workup process, and causes of Anemia. The case study of…

One year on, HIMaC² is hard at work addressing the challenges of sustainable energy through numerous projects and research initiatives.

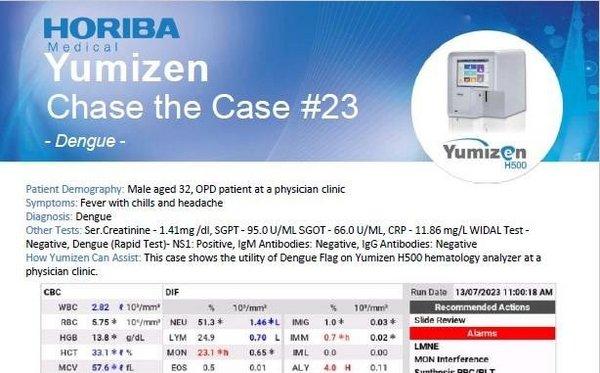

This month's clinical case shows the utility of the Malaria flag on the Yumizen H500 hematology analyzer assisting physicians at the hospital…

A-TEEM Technology with Multivariate Analysis Speeds up Data Evaluation

HORIBA Medical is proud to announce that its Yumizen hematology analyzers have won the 2023 Medical Device Network Excellence Award in the category…

HORIBA 宣布已收购 Process Instruments, Inc.。这一举动将加强 HORIBA 工业过程监测技术。

This acquisition will expand business ventures by leveraging Process Instruments’ industrial process instrument business oriented primarily around…

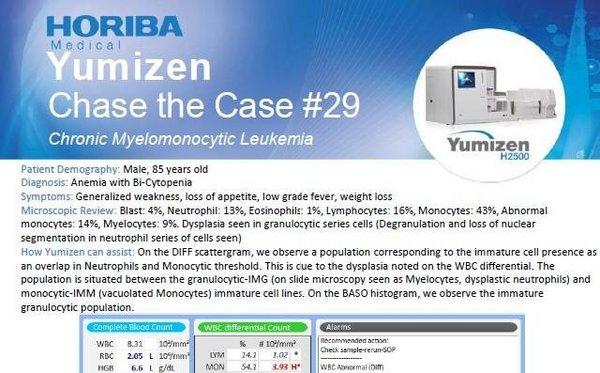

Introducing this month's Chase the Case - Take a closer look at how our hematology analyzers, with their precise ALY* & IML* parameters, contribute to…

This issue features "HORIBA’s Initiatives in the Next-Generation Energy and Environment Fields". Realizing a carbon neutral society is accelerating…

The 39th issue of the QSP Newsletter features Cold Agglutinin Disease (CAD), a form of autoimmune hemolytic anemia at cold temperatures. You can learn…

Overview of Our Torque Matching Road-to-Rig Solution

HORIBA Medical is proud to announce that its Yumizen H500 benchtop hematology analyzer has won the Best New Clinical Instrumentation Award for 2022 at…

Chase the Case #23 showcases a case obtained with HORIBA's new Yumizen H500 analyzer, specifically designed for small mid-size laboratories. Discover…

Encouragement and Support of Up-and-Coming Scientists and Engineers Researching Analytical and Measurement Technologies.

The latest issue features thalassemia, one of the Hemoglobinopathies. Discover how it occurs, the categories, population patterns, and more. This…

On the occasion of HORIBA Medical's 40th anniversary, on July 7, 2023, Atsushi Horiba received the medal of Honorary Citizen of the City of…

Chase the Case #22 introduces a case from India, a female patient aged 48, diagnosed with Acute Monoblastic Leukemia (AML). See how it was indicated…

In June 2023, HORIBA Medical became a corporate member of the International Council for Standardization in Haematology (ICSH), one of the most…

Continuing from the last issue, this issue will introduce hemoglobinopathies in more detail. Learn about their inheritance and one of the most common…

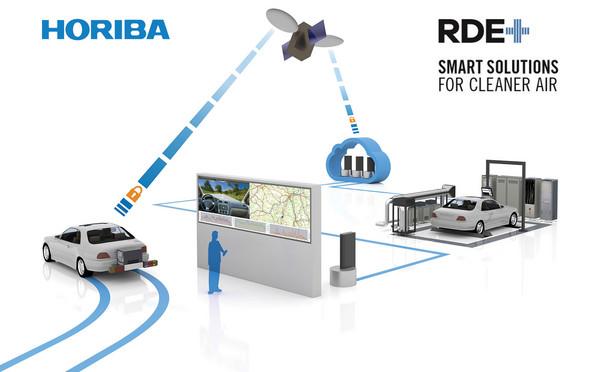

The HORIBA QCL-IR PEMS is based on the proven IRLAM technology and will measure up to 8 components with high accuracy in a single unit to meet the new…

Chase the Case #21 discusses a male patient aged 57, diagnosed with Chronic Lymphocytic Leukemia (CLL). Look at the DIFF scattergram of this case…

HORIBA MIRA and HORIBA UK have won an award from JLR (Jaguar Land Rover) at its seventh annual Global Supplier Excellence Awards.

The 36th issue of QSP Newsletter discusses hemoglobinopathy, a group of blood disorders that affect red blood cells in addition to the monthly digital…

The 20th issue of Chase the Case discusses a case of a male aged 64 with lymphoproliferative syndrome. See how the Yumizen H2500 hematology analyzer…

Continuing from the last issue, we discuss malaria as well as the monthly QSP slide presentation in this QSP Newsletter 35. You will learn more about…

HORIBA Scientific, world leader in Raman microscopy, announces the new LabRAM Odyssey, a fully automated and remotely controllable system.

The QSP Newsletter 34 features malaria in addition to the monthly QSP slide introduction. Let's review the different types of malaria and learn the…

LabRAM Odyssey Semiconductor for semiconductors R&D process qualification and optimization

Enhanced Capabilities/Product Lineup for System to Measure Water Quality

This year’s theme is ‘Analytical and measurement technologies that contribute to the realization of next-generation semiconductor devices.’

The 19th Chase the Case discusses a case of a male aged 32 with sickle cell anemia. The presence of abnormal levels or immature neutrophils,…

Realization of Advanced Data Management Accommodating Measurement Items in Accordance with the Euro 7 and Other Next-generation Emission Standards.

Precise Management and Control of Vacuum Chamber Conditions Contributing to More Efficient Semiconductor Production

Precise Management and Control of Vacuum Chamber Conditions Contributing to More Efficient Semiconductor Production

• Tocadero ONE now determines the POC/VOC content in water in a single measurement using a photoionization detector

• Faster and more accurate…

Abstract

A quadrupole mass spectrometer (QMS) was applied to observe the changes in gas species during the SiN etching in CHF3/O2 plasma. Under the…

The Two New X-ray Analytical Microscopes Boost Efficiency and Performance of Your Analysis

The QSP Newsletter 33 presents a detailed blood morphology case study of a patient diagnosed with Essential Thrombocythemia. This issue also focuses…

Trio of Yumizen C analyzers will offer new levels of instrument and reagent synergy for small and mid-sized labs

The 18th Chase the Case presents a case of a male patient aged 49, diagnosed with lung cancer. Lung cancer is a possible cause of lymphocytosis and…

The 32nd QSP Newsletter talks about the case of a 14-year-old female with microcytic anemia. Expert comments that very abnormal neutrophils. This QSP…

The 17th Chase the Case presents a case of a female patient aged 55, diagnosed with Acute Promyelocytic Leukemia (APL). The Double Hydrodynamic…

On January 26, 2023, HORIBA shall celebrate its 70th anniversary.

HORIBA, Ltd. (Hereinafter HORIBA) embarked on its challenging journey as an entity…

Lymphocytosis is a relatively common finding and can be due to a wide range of conditions either reactive e.g. Viral infections Epstein Barr Virus…

This QSP Newsletter 30th edition discusses a case of 66-year-old male with Myelofibrosis. This edition also presents the interpretation of blasts on…

Dramatic Reductions in Maintenance Work Improve Wastewater Treatment Efficiency

Today marks the death of a truly extraordinary scientist and man, known as Chandrasekhara Venkata Raman (7 November 1888 - 21 November 1970).

This QSP Newsletter 29th edition presents a slide review of patient aged 78 in clinical hematology unit with hyposegmented, hypogranulated,…

Abstract

As part of European Automobile Manufacturers' Association-funded projects, the Mobility Innovation Hub has been collaborating with the…

A new HORIBA Chair will work with industry and academia to champion and develop new propulsion technologies, creating the next generation of battery…

Did you know that 1 in 4 people worldwide die of conditions related to thrombosis? [1]. October 13th marks World Thrombosis Day, a campaign designed…

HORIBA Group, a leading global provider of analytical and measurement systems, officially announced and celebrated the grand opening of the HORIBA…

Dr. Adam Gilmore, HORIBA Scientific, Piscataway Office, shared the 2022 Japanese Photochemistry Association Technical Award for Fluorescence…

The experienced automotive supply manager takes over the responsibility for HORIBA FuelCon’s manufacturing, upscaling of industrial production, and…

This QSP Newsletter 28th edition discusses the case of a 70 year-old male in perioperative resuscitation unit with Anisocytosis, Microcytes,…

HORIBA eHUB, located in Barleben, Germany, is a new facility to strengthen the production capabilities of HORIBA FuelCon GmbH, which has been in…

On September 9th, HORIBA Europe GmbH, the German base of the HORIBA Group, held a ceremony to celebrate the expansion of its production base for gas…

The 16th issue of the Chase the Case discusses the Brazilian clinical case of a girl aged 2, diagnosed as Chediak-Higashi syndrome. The Yumizen H2500…

Introducing a new ASTM standard which uses a more rapid, purely-optical, reagent- and extraction-free, method for Detection of Water-Soluble Petroleum…

Encouragement and Support of Up-and-Coming Scientists and Engineers Researching Analytical and Measurement Technologies

The 15th issue of the Chase the Case discusses a case of a 78-year-old male CCU patient with acute myeloblastic leukemia. The clinical data presented…

The 14th issue of the Chase the Case discusses a case with the chronic lymphocytic leukemia with transformation to Non-Hodgkin's Lymphoma, possible…

This QSP Newsletter 27th edition presents a case of platelet count monitoring at a clinical hematology unit. The blood slide relects aniosocytosis,…

No retrofitting necessary for existing test facilities, improved energy efficiency with up to 97% efficiency.

Equipped with patented synchronous…

HORIBA Medical is pleased to announce the launch of new products in its Yumizen H500 & H550 hematology product family, the compact benchtop hematology…

New generation Yumizen G800 and G1550 automated analyzers plus new range of ready-to-use reagents for hemostasis highlighted on Booth #1225

The 13th issue of the Chase the Case discusses a case provided by a laboratory in Catalonia, Spain. The case is of a 50 year-old female with the Acute…

This QSP Newsletter 26th edition presents the case of hematology clinic patient in Clinical Hematology unit whose condition is deteriorating. The…

The Headquarter of HORIBA Europe is located close to Frankfurt and was founded in 1972 as the first European subsidiary.

Enabling process metrology approaches and process improvement for leading-edge processes and next-generation semiconductors

HORIBA Taiwan was…

To wisely "Create," "Use," and "Store" Hydrogen/Energy

In order to achieve carbon neutrality in 2050, the use of new energy sources such as…

Sentronics is pleased to announce their partnership with HORIBA UK to launch the next generation Ultrasonic Fuel Consumption Measurement Sensor, the…

This QSP Newsletter 25th edition presents a case of 59-year-old female having Leukopenia with Erythroblasts. This issue also provides you with an…

This QSP Newsletter 24th edition discusses a case of 83-year-old female with Hyperleukocytosis. This issue also includes various ways of malaria…

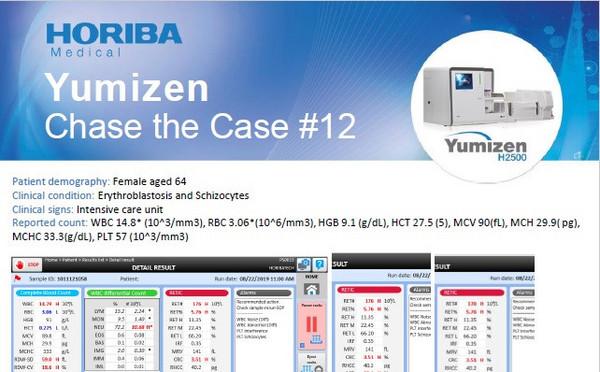

The 12th issue of the Chase the Case has been published! The 12th issue of Yumizen “Chase the Case” will show you the NRBC, Schizocytes and large…

The 11th issue of the Chase the Case has been published! The 11th issue will show you a clinical case of 85 year-old female with suspected Chronic…

The experienced automotive manager assumes overall responsibility for all segments at HORIBA Europe: Automotive, Process & Environmental,…

HORIBA Medical’s D-dimer immunoassay displays excellent analytical performance in independent evaluation study

Completion and commissioning of one new company building each at the sites in Magdeburg-Barleben, Saxony-Anhalt and Leichlingen, North…

The theme of 2022 Masao Horiba Award is " Analytical and measurement technologies that contribute to the use of hydrogen for a decarbonized society."

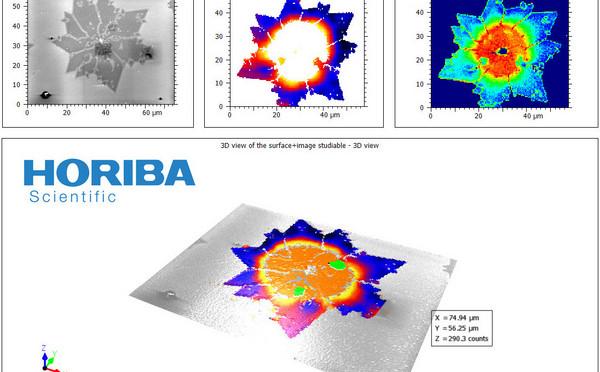

For the correlative analysis of Raman, AFM, AFM-Raman, cathodoluminescence and fluorescence data and microscopy images (optical, scanning probe…

For continuous fast-response measurements of various low-concentration exhaust gas components with the lowest sample flow rate to realize carbon…

This QSP Newsletter 23rd edition discusses the case of 84 years old male who is suspected to have acute myeloid leukemia. The newsletter provides a…

HORIBA, a global leader in spectroscopy with over 200 years’ experience, joins the lifETIME Centre for Doctoral Training in engineered tissues for…

Latest issue of HORIBA Technical News Letter “e-Readout”

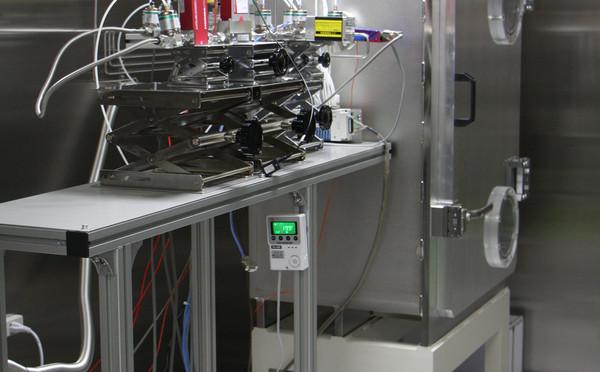

Abstract Precursor delivery via bubbling presents technical challenges on the production…

The 10th issue of the Chase the Case talks about severe babesiosis due to Babesia divergens acquired in the United Kingdom. Yumizen H2500 hematology…

HORIBA’s contribution to the hydrogen energy sector will help achieve carbon neutrality

This year’s theme is ‘Analytical and measurement technologies that contribute to the use of hydrogen for a decarbonized society’

50-user access ideal for large hospital trusts and University/Medical School remote haematology learning activities

This QSP Newsletter 22nd edition talks about the case of 20 years female old, hospitalized in the gynecology unit. This issue also gives knowledge of…

Dr. Ahmed Abdelfattah Wins 2022 Honor

The 9th issue of the Chase the Case discusses a clinical case of a 61-year-old female who is diagnosed with "Chronic Lymphoid Leukemia". Here is the…

HORIBA Scientific is presenting a short course with the Pittcon organization, entitled, “Rapid Analysis of Hemp/Cannabis and other Botanicals using…

First live UK demonstrations of Yumizen G1550 automated haemostasis and newly launched Microsemi CRP LC-767G POC haematology analysers

This QSP Newsletter 21st edition talks about the 5th slide case of QSP 2.0 released in Dec 2021. The patient is 66 years old anemic male who is at…

HORIBA Scientific is proud to announce that the “SPEX Forensics,” a leading brand in forensic light sources products, is celebrating its 25th…

The 8th issue of the Chase the Case talks about a 36 year-old male who has Malaria (Plasmodium) infection. This infection represents a specific…

This QSP Newsletter 20th edition talks about the 6th slide of the QSP2.0 where a 49-year-old male’s slide review shows Anisocytosis (++), Echinocytes…

Animal parasites expert to share key knowledge on testing best practice to minimise risk from feeding raw diets.

Aiming to expand market share in the renewable energy and power semiconductor markets

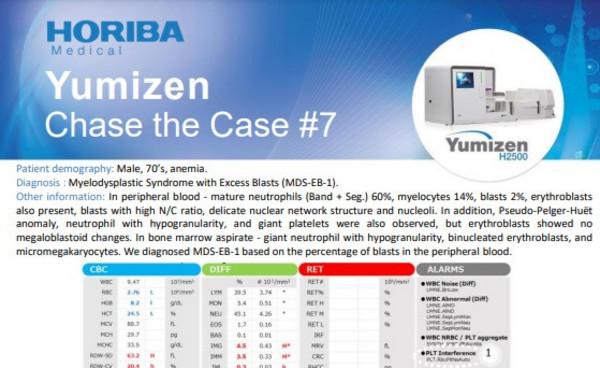

The 7th issue of the Chase the Case talks about the interpretation of hematology parameters, matrix, histogram and its correlation with cellular…

Company receives TechWorks 2021 Award for ‘Manufacturing Site of the Year’ in recognition of the contribution made by the HORIBA UK team.

Palaiseau, Saclay Campus, France, December 3rd, 2021

Organized every three years, the International Investment Trophy is awarded to foreign companies…

* HORIBA ABX SAS

A blood count is one of the most common blood tests that provides valuable physiological information about the patient’s state. The…

This QSP Newsletter 19th edition talks about the 77 year old male whose slide review represent Leukocytosis, Myelemia, erythroblastosis, Anemia,…

The 6th issue of the Chase the Case is about a patient after chemotherapy treatment for myelodysplastic syndrome, a disease caused by interruption of…

HORIBA Scientific, a global leader in the production of high-performance spectroscopy systems and solutions, is proud to be hosting a joint webinar…

This QSP Newsletter 18th edition discusses "Neutrophilia and platelet aggregation". The QSP2.0 slide no. 2 where slide review shows Neutrophilia,…

Today HORIBA announced the addition of the new HyFQ-2000 series Hydrogen Fuel Flow Meter to its fuel consumption measurement portfolio, which now…

This issue features the "2021 Masao Horiba Awards for Spectroscopic Analysis and Measurement Technology in the Life Sciences". The theme of the issue…

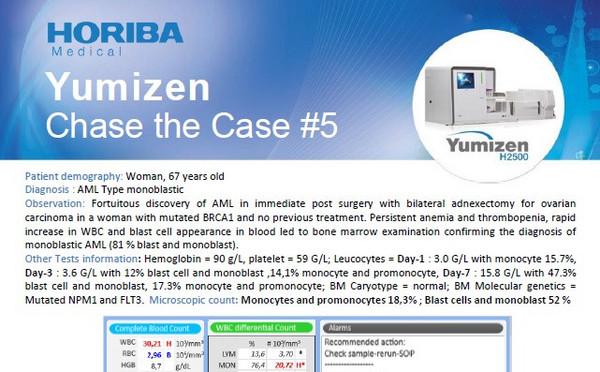

The 5th issue of "Chase the Case" is about the acute myeloid leukemia type monoblastic (AML-M5b).

Download and subscribe ► Chase the Case page

What…

Glasgow University Vet School haematology specialist to discuss how to address blood sample challenges to ensure quality results and enhance patient…

Latest issue of HORIBA Technical News Letter “e-Readout”

Abstract We developed the Partica CENTRIFUGE CN-300, centrifugal nanoparticle analyzer to…

HORIBA Scientific, a global leader in the production of high-performance spectroscopy systems and solutions, announces it has validated the HORIBA…

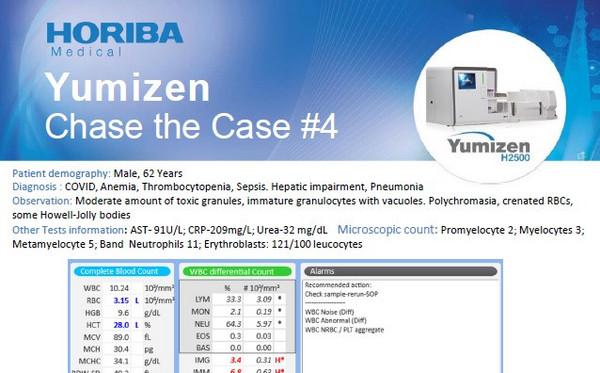

The 4th issue of "Chase the Case" is about the COVID and sepsis infection and its impact on hematology analysis. LMNE matrix of Yumizen H2500 is in…

North American Demo Lab will expand Covalent’s chemical analysis services and showcase HORIBA’s analytical instrumentation

The 13th of September 2021 is World Sepsis Day. Accounting for 11 million deaths in the world annually[1], sepsis is the number one cause of death in…

This edition talks about "Burkitt's Lymphoma" which is one of the six cases released in QSP 2.0 in June 2021. Burkitt lymphoma (BL) is a rare type…

Science and Engineering, at Drexel University, will present 'The Family of 2D Carbides and Nitrides (MXenes),' and will demonstrate how despite the…

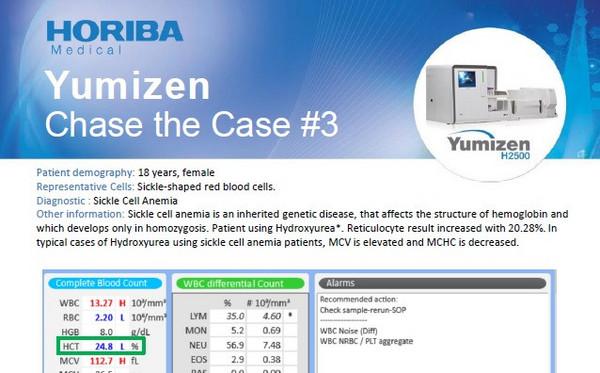

The 3rd issue of "Chase the Case" is about “Sicle Cell Anemia”. Sickle cell anemia is an inherited genetic disease, that affects the structure of…

Merging Separating and Visualizing Technologies Offers New Value for R&D Applications in a Wide Variety of Fields

Why wait for results? Vets can see for themselves how easy it is to do in-house PCR testing.

Encouragement and Support of Up-and-Coming Scientists and Engineers Researching Analytical and Measurement Technologies

HORIBA, Ltd. (hereinafter referred to as "HORIBA") has launched a brand-new Process Gas Analyzer PLGA-1000 in accordance with the release of an…

Value of in-house PCR analysis for pathogen testing highlighted at recent veterinary CPD webinar discussing the importance of screening imported dogs

HORIBA, Ltd. (hereinafter referred to as "HORIBA") today announced that it has developed an innovative proprietary gas analysis technology called…

This edition talks about one of the six cases released in QSP 2.0 in June . A case where slide is reviewed for T-cell lymphoproliferative syndrome,…

HORIBA TECHNO SERVICE Co., Ltd. (hereinafter, "HORIBA TECHNO SERVICE") is participating in a project as a member of the chemical analysis team for the…

The second issue of "Chase the Case" is about “Burkitt’s Lymphoma”. Burkitt lymphoma is a rare type of cancer. In adults, Burkitt lymphoma is often…

Expansion in capability within the power electronics field, to establish supply system within the group, enables a faster response to individual…

Established with a donation of state-of-the-art HORIBA equipment and technology

Expanding Compatibility with Chemicals and Contributing to a Higher Yield Rate in Semiconductor Manufacturing

Platelet counting is an important part of hematology analyzers. Platelets are essential in primary hemostasis and rapidly form a loose platelet plug…

The consortium will assess multiple new or existing process analytical technologies (PAT), including HORIBA’s A-TEEM™ fluorescence technology

Latest issue of HORIBA Technical News Letter “e-Readout”

Abstract Magnetism is mysterious thing. Despite magnetic fields being everywhere, from the…

HORIBA Medical’s free educational webinar will discuss the importance of testing imported dogs to detect and address emerging disease threats.

HORIBA Medical has introduced a new Pre and Post analytical compact sorter, designed and developed by NGNY Devices, to help hematology laboratories…

The latest issue 13 May 2021 has been published! This Newsletter is based on the monthly case studies provided in HORIBA Medical’s QSP program…

New Software Version 2.36 for HORIBA’s Yumizen G800 Hemostasis Analyzer Enables Automatic Tube Filling Level Checking

The latest issue 12 April 2021 has been published! This Newsletter is based on the monthly case studies provided in HORIBA Medical’s QSP program…

Viritech are the latest in a series of automotive innovators to cluster around world-class engineering and testing services.

HORIBA Automotive announced today its electrification offering to the industry which includes solutions for the different stages of vehicle…

TOGG, Turkey’s Automobile Initiative Group comprising of five Turkish industry giants, has announced it will be working with UK-based engineering…

HORIBA Instruments Inc. announced today it has been awarded a contract to provide the Environmental Protection Agency (EPA) emissions measurement…

The latest issue 11 March 2021 has been published! This Newsletter is based on the monthly case studies provided in HORIBA Medical’s QSP program…

Palaiseau, France, March 8th, 2021

HORIBA Scientific, global leader in Raman spectroscopy for over 50 years, is proud to announce the launch of their…

Dr. Luca Lanzano Wins 2021 Honor

HORIBA Scientific, global leader in Raman spectroscopy for over 50 years, is proud to announce the launch of their new and innovative LabSpec 6…

Latest issue of HORIBA Technical News Letter “e-Readout”

Abstract This article reports on nano-characterization of 2D transition metal…

The latest issue 10 February 2021 has been published! This Newsletter is based on the monthly case studies provided in HORIBA Medical’s QSP program…

“We are incredibly pleased to be welcoming REE to MIRA Technology Park, where they join a cluster of companies dedicated to delivering innovative…

Strengthening Business by Selling Experiences Through Application Proposals and Consultation

HORIBA Medical, specialists in automated in vitro diagnostic systems for hematology, hemostasis and clinical chemistry analysis, has obtained the CE…

Aiming to expand market share through local production of high-end models

Committed to Implementing a System That Enables the World’s Highest Level of Particle Analysis

MIRA China has invested in a new Anthony Best Dynamics Kinematics and Compliance (K&C) test rig at its development centre in the Xiangyang, Hubei…

Latest issue of HORIBA Technical News Letter “e-Readout”

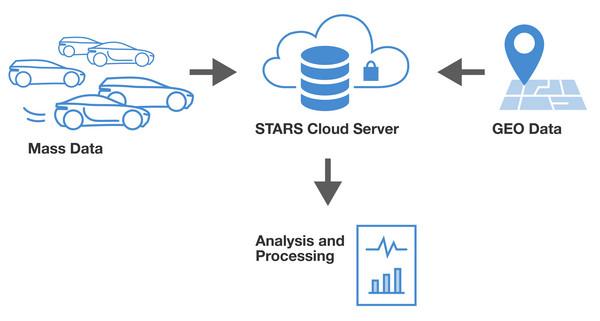

Abstract Testing and evaluation of high-level autonomy features requires large amounts of…

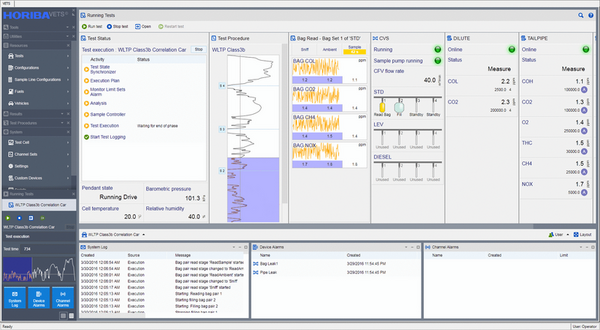

HORIBA today announced the availability of STARS VETS, its vehicle emission test automation software for Windows 10 64 bit Operating System.

This time we focus on the Thrombotic Thrombocytopenic Purpura (TTP), an acute disorder characterised by thrombocytopenia and mircoangiopathic…

Electrification, cybersecurity, autonomous mobility and the emergence of fuel cell powertrains – these are just a few of the recent trends we’ve seen…

The HORIBA Group has established a new corporate "Code of Ethics," which will serve as a global standard for the group.

The HORIBA Group set forth…

This year’s theme is ‘Optical/Spectroscopic Measurement Technologies for Life Science’

In addition to the Automotive segment, the new president of HORIBA Europe GmbH Dr. Robert Plank is now also responsible for the Process &…

Affordable Raman engine for high volume OEM customers with unmatched detection limit

NJBIA Certifies HORIBA NJ Office as a Certified Site for Infectious Disease Prevention

HORIBA MIRA Limited, announced a comprehensive CAV validation ecosystem, "ASSURED CAV," which is set to open in March 2021.

Founding Director of HORIBA Jobin Yvon IBH Awarded For Pioneering the UK Fluorescence Lifetime Industry

HORIBA Medical announces the launch of the Yumizen C1200 clinical chemistry system in North America. The Yumizen C1200 is designed for low- to…

HORIBA Medical has obtained U.S. FDA and Health Canada clearance in North America for its next generation clinical chemistry system, the Yumizen…

HORIBA increases laboratory space from 50 to 105 square meters to meet increased service requests. Increased capacity enables even more flexible…

HORIBA today announced the automatic driving system, ADS EVO, which is a driving robot for vehicle testing. The ADS EVO improves the efficiency of…

HORIBA, a leading supplier of automotive test systems, has launched an advanced rugged enclosure for its versatile OBS-ONE portable emissions…

HORIBA is announcing a strategic agreement with CRMT to work on the development of hydrogen-based engines and vehicles.

Towards the Commercialization of Analytical and Measuring Instruments that Combine a High-Performance Liquid Chromatograph and a Raman Spectrometer

Market novelty allows LIDAR testing in anticipation of the UN Level 3 Regulations for partially autonomous vehicles to enter force in January 2021. …

Expert level Raman Images for Everyone with EasyImage™

Thank you for your continued patronage of HORIBA products.

Recently, we have noticed that that our logo or official website was used or linked by some…

New generation of MEDAS (Multi-Function Efficient Dynamic Altitude Simulation) significantly improves altitude testing.

New MEDAS HD allows for…

QSP 2.0: An Affordable Digital tool for “Skills Evaluation & Training” in blood morphology

HORIBA has launched a new virtual-based solution to Real Driving Emissions (RDE) development – which could save businesses up to $17m in prototype…

Montpellier and Grenoble, France, July 21, 2020

HORIBA Medical, a subsidiary of Japan-based HORIBA Group, the global leader for measurement and…

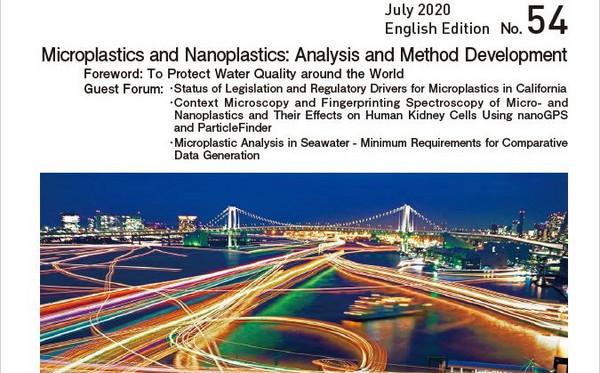

The featured topics of this issue are “Microplastics and Nanoplastics: Analysis and Method Development”

This special issue illustrates the important…

HORIBA Medical has established a partnership with BioMedica Diagnostics Inc. (BMD)

HORIBA is thrilled to announce a strategic collaboration with Qnami, leader and pioneer in scanning NV magnetometry based on diamond quantum sensing.

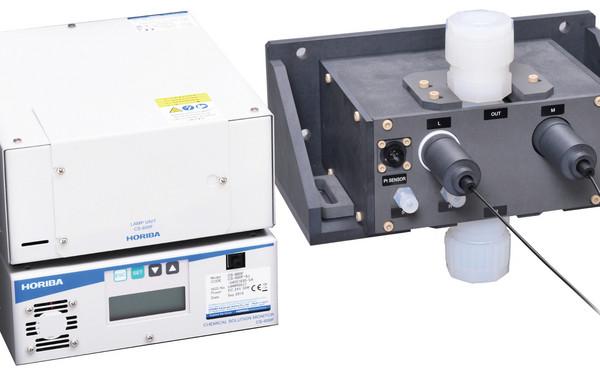

HORIBA Advanced Techno., Co., Ltd. launched the CS-620F, a fiber optic type hot phosphoric acid concentration monitor on June 27, 2020. The monitor…

HORIBA Scientific, a global leader in Raman solutions, is pleased announce that Dr. Linda Kidder, Life Science Business Development Manager from…

Analytical VIP Program will showcase latest products, and links to videos and collateral

HORIBA Scientific, a global leader in Raman solutions, is pleased announce that Dr. Bridget O’Donnell, Manager of Raman Applications for HORIBA…

Dr. Linda Kidder will focus on key life science markets and applications

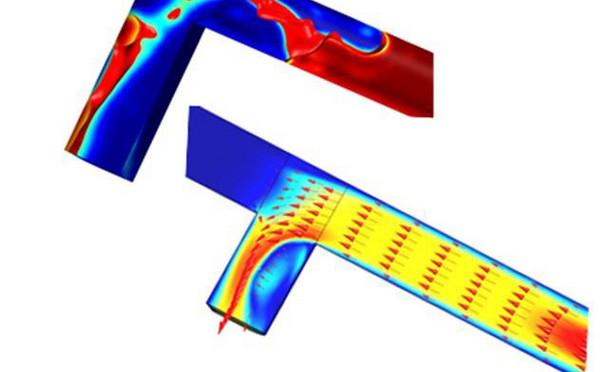

HORIBA Medical has developed the digital simulation activity within its Innovation & Development center for several years, relying on the COMSOL…

Cooperation in the development of modern applications regarding data transfers between the real world and virtual reality as well as additional…

HORIBA, Ltd. and HORIBA Advanced Techno, Co., Ltd. (hereinafter collectively referred to as “HORIBA”) have been committed to improving the operation…

HORIBA Tocadero GmbH (hereinafter, “HORIBA Tocadero”) in Germany launched its official website as of March 2020.

The global community currently faces…

4th Generation Fluorolog covers the broadest range of luminescence research

HORIBA, Ltd. (HORIBA) was listed in the 2020 All-Japan Executive Team Rankings according to the U.S. based leading global financial magazine…

Dr. Jelle Hendrix Wins 2020 Honor

Yumizen G200 confirmed as suitable for blood coagulation external quality assessment testing

Award recognizes innovation and projected market impact

HORIBA Instruments Incorporated, a part of the HORIBA Group of worldwide companies and a supplier of preeminent analytical equipment, announces an…

LabRAM Soleil™ sets new standards in Raman microscopy.

This year’s theme is ‘Optical/Spectroscopic Measurement Technologies for Life Science’

The Focus of this Annual International Event is on the Latest Advances in Applied Raman Spectroscopy

Two parties have signed a contract to meet the company’s requirements of biological samples for the validation and development of IVD solutions and…

HORIBA, a global leader in measurement and analysis solutions for research and industry, announces the appointment of Laurent Fullana as President of…

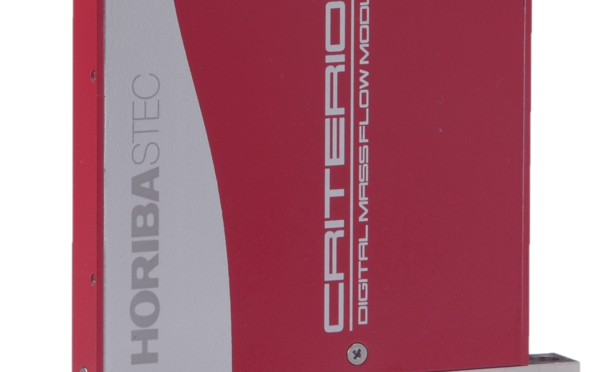

Supports Advanced Gas Flow Control Needed for Miniaturization of Semiconductors

Instantaneously Providing a Definite Numerical Value for Glossiness

Joint R&D activities for modern applications and additional services for Vehicle in the Loop systems (VIL). Use of synergies in development and test…

HORIBA held the Jobin Yvon 200th Anniversary Ceremony at École Polytechnique*1, a French public institution of higher education and research in…

The facility that handles everything from development to production, after-sales service will be ready in 2021

HORIBA Medical has just purchased a 1 hectare plot next to its current site on the Euromédecine business park in Montpellier, with a view to expanding…

HORIBA, Ltd. (Head Office: Kyoto, Japan; hereinafter, “HORIBA”) announced today that it has established CELL 0(zero), a new testing laboratory for…

PoliSpectra® M116 provides simultaneous acquisition breakthrough in UV-NIR spectroscopy

- Enhancing the service business globally -

HORIBA to launch the MEXA-2010SPCS for upcoming Sub-23nm particle number counting legislation. First automated particle counter verification system…

Demonstrating “measurement technologies” for exploring and preserving cultural properties

Full Spectrum Imaging Camera Captures Ultra-high Definition Images

Sleek Design High Sensitivity Spectrograph Complements Any Lab Environment

HORIBA Scientific, a global leader in Fluorescence solutions, is pleased to be offering a free webinar that will discuss the challenges faced by Water…

The 7th International Conference on Advanced Applied Raman Spectroscopy took place on 24th -25th June and attracted top scientists in the field of…

“Fluorescence in Industry” Chapter Discusses Using Photon Counting Instrumentation for Fluorescence Lifetime Measurement

Prof. Dr. Marcus Rieker, Director Academic Affairs at HORIBA Europe GmbH, is the new chairman of the Board of ASAM e.V. Further development of the…

The government of Japan has announced the recipients of the 2019 Spring Imperial Conferment of Decorations.

HORIBA Medical and LABORATORIO ECHEVARNE, one of the major Laboratory Medicine providers in Europe have signed a multi-year, multi-site contract for…

Making the World Cleaner and More Efficient

Jobin Yvon celebrates in 2019 the 200th anniversary of its foundation. Now in the form of HORIBA FRANCE SAS, this legendary optics firm has pioneered…

HORIBA is expanding its test offering in Floersheim to meet increased customer testing demands

HORIBA showcases applications, products and services in Stuttgart, Germany from May 21st – 23rd

HORIBA, Ltd. announced that, together with one of its Group companies, HORIBA Advanced Techno Co., Ltd., on February 5, 2019, it donated water quality…

HORIBA Scientific, global leader in Raman instrumentation and other spectroscopy solutions, announces the organisation and sponsorship of RamanFest…

HORIBA acquires additional land for future plant expansion in response to the increasing global demand for HORIBA FuelCon products.

Open Fluorescence Workshop Topics Include Materials Science/Nanotechnology, Analytical/Chemometrics, and Bio- and Medical Research

The new approach helps to make the world cleaner and equips customers for future legislative changes. HORIBA improves the measurability of generated…

HORIBA co-hosts workshop on Measuring Microplastics: Building Best Practices for Sampling, Extraction and Analysis

Co-hosts include Southern…

We would like first of all to extend our sincere gratitude to our valued customers for patronizing our products.

In order to improve information…

HORIBA Scientific, global leader in fluorescence instrumentation and other spectroscopy solutions, announces that the annual FluoroFest symposium will…

HORIBA, Ltd. (Head Office: Kyoto, Japan; hereinafter, “HORIBA”) has announced the release of APCA-370 ambient carbon dioxide monitor, which is used in…

The 2019 Masao Horiba Awards have started to accept applications on February 18th. Now in its 16th iteration, HORIBA, Ltd. started this annual…

Based on innovative ‘data mining’ techniques and combined with Full Blood Count, the Malaria suspicion flag is optionally available on both the ABX…

HORIBA Medical announces the availability of a D-Dimer reagent for their semi-automated Hemostasis instruments.

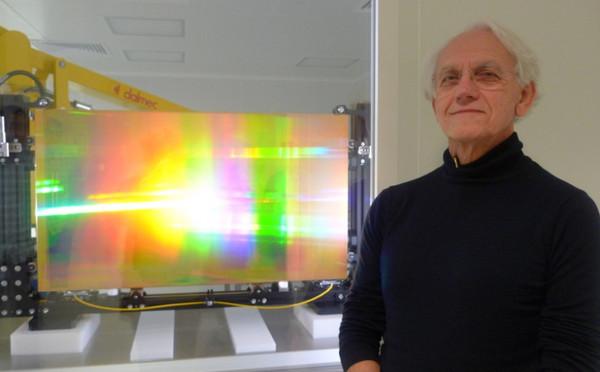

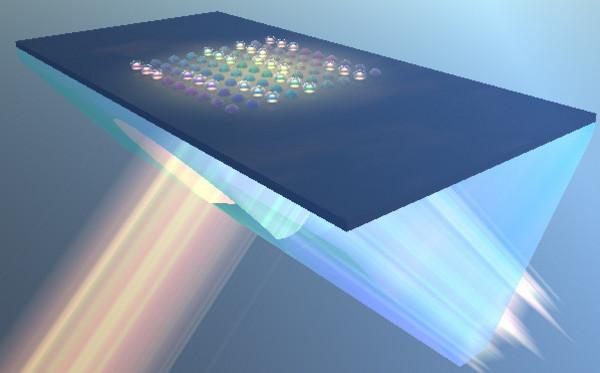

HORIBA, Ltd. (Head Office: Kyoto, Japan; hereinafter, “HORIBA”) is pleased to announce that a diffraction grating developed by its Group company,…

Horiba Scientific Announces Standard Microscope Spectroscopy (Sms) Systems

- Augmenting the Technology of Particle Characterization Instruments -

XGT-9000 Combines New Imaging Technology with High Sensitivity for High Speed Analysis of Foreign Materials in one Instrument

HORIBA UK Ltd. is pleased to welcome back Dr. Simon FitzGerald to its Scientific team in the role of Technical Manager. He will lead the company’s…

Dr George Gillespie OBE, Executive Vice President for HORIBA Automotive Test Systems (ATS) has been appointed as the 81st President of the Society of…

HORIBA, Ltd. (Head Office: Kyoto, Japan; hereinafter, HORIBA) announced today that its subsidiary HORIBA KOREA Ltd. has established its new head…

Acquisition positions HORIBA as a leading solutions provider in the development and validation of battery and fuel cell systems for electrified…

HORIBA Scientific, global leader in fluorescence instrumentation and other spectroscopy solutions, is proud to introduce Lumetta, an innovative- Fixed…

- Among the Best in the Industry for its Lightweight and Compact Footprint -

Research to focus on better connectivity between transportation and energy sectors

- HORIBA New Jersey Optical Spectroscopy Center to Open -

•Acquisition will assert HORIBA’s position as a leading solutions provider in the development of battery and fuel cell systems for electrified…

HORIBA MIRA – a world-leader in advanced engineering, research and product testing – has partnered with Japanese Tier 1 Automotive Supplier, Keihin,…

HORIBA, Ltd.

Oxford Instruments Nano Analysis

Greetings, and we trust that this communication finds your company enjoying strong and prosperous…

An external incentive award for researchers in analytical and measurement technologies

Research on Advanced Analytical and Measurement Technology in…

HORIBA Medical Partners with Canadian Distributor BioPacific Diagnostic, Inc.

Irvine, California (July 5, 2018) – HORIBA Medical, a worldwide…

Reinforcing Capability to develop Fluid Measurement/Control Technology for the Semiconductor Production Process

Completion is scheduled for HORIBA BIWAKO E-HARBOR in May 2019

General overview on Surface Plasmon Resonance Imaging.

Cooperation aims to support industrialization and competitiveness of SEMS

HORIBA, Ltd. (HORIBA) was listed among the top-ranked companies in its sector according to the US-based leading global financial magazine…

New service supports customers with crucial service modules. Three individual service modules to enhance flexibility for customers and reliability of…

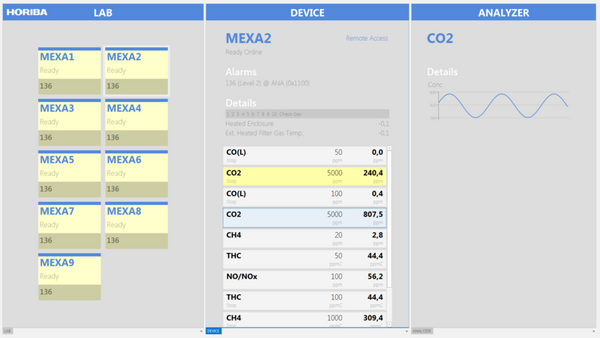

MEXA series to be complemented by highly dynamic system with quick response time due to compact gas cell and 5 Hz sampling rate. Accurate and reliable…

New compact design of Micro Dilution Tunnel (MDLT) allows easy installation and unprecedented speed of flow control. Temperature-stabilized sensors to…

Revolutionary Two-In-One Fluorescence and Absorbance Spectrometer Earns Silver Honors

Highly compact sensor-based unit to offer immediate emission data and analysis of individual or mass data application. Combination of measuring system…

HORIBA to present extensive portfolio of brake test solutions at EuroBrake in The Hague, Netherlands, from May 22 to May 24 in the World Forum at…

MIRA Technology Park, run by HORIBA MIRA, one of our group companies, won the ‘International Trade’ award at the Queen’s Awards for Enterprise, the…

Mobile app CoDriver takes complexity out of the RDE test requirements. Real-time guidance for drivers helping to maximize the output of valid RDE…

MEDAS offers extended performance due to new options for the fields of temperature and humidity control.

HORIBA, an OEM of instruments and measurement systems, has secured a prestigious iF DESIGN AWARD 2018, in the ‘Product Design’ discipline, with its…

Revolutionary Two-In-One Fluorescence and Absorbance Spectrometer Honored for Ingenuity and Innovation

HORIBA UK Ltd, Medical…

VLSI Research Inc. (stylized VLSIresearch) in the USA announced its 2017 All-Stars of the Semiconductor Industry, nine executives who made outstanding…

HORIBA Medical is proud to announce the development of its offer with the extension of the Hematology portfolio into the Hemostasis field.

For over…

Dr. Francesco Cardarelli Wins 2018 Honor

His Royal Highness The Duke of Cambridge has today visited MIRA Technology Park, the UK’s leading automotive technology park and Enterprise Zone, as…

HORIBA MIRA, Ltd. (HORIBA MIRA) – a HORIBA Group company in UK that specializes in advanced vehicle engineering, research, development and testing –…

HORIBA held a press conference in Kyoto on October 24 to announce a new executive appointment, a decision that was made at a board of directors…

With the new fuel consumption measurement system FQ-3100DP, HORIBA customers will be prepared for strict analysis processes

HORIBA continuously strives to improve customer solutions and offers reliable and dedicated services

With the new chassis dynamometer VULCAN Evo, HORIBA provides an optimum performance and operability during the test procedure.

Exclusive insights, top-class participants, cutting edge know-how

HORIBA UK supplies MAHLE Powertrain with a 4WD rolling road for use in a vehicle test chamber capable of simulating at-altitude driving conditions.

As of November 1st, Dr. Robert Plank is the new managing director of the segment Automotive Test Systems (ATS) at HORIBA Europe GmbH.

Establishing a Collaborative Agreement in Data Sciences

Shiga University, a national university in Japan, has entered into an agreement with HORIBA,…

As I guess most must be aware, the automotive industry is probably experiencing the most challenging time in its one hundred year history.

HORIBA, Ltd. (Headquarter in Kyoto, Japan) and HORIBA ABX S.A.S. (Headquarter in Montpellier, France, referred to as HORIBA Medical) announced today…

In July 2015, HORIBA MIRA became part of the HORIBA Group. Both companies have since benefitted from the collaboration, growing their capabilities…

Efficiency, productivity enhancement and clean mobility are primary objectives that unite all HORIBA customers.

Since September, real driving emissions (RDE) demand new requirements and testing procedures. As the worldwide leading supplier of emission test…

With the increasing demand for hybrid and electric vehicles, the battery industry has experienced exceptionally high growth. The emergent industry has…

Introducing a Laser Analyzer Capable of Reducing Annual Maintenance Costs by Half

An external incentive award for researchers in analytical and measurement technologies

HORIBA STEC, Co., Ltd. (hereafter HORIBA STEC) — a subsidiary of HORIBA, Ltd. (hereafter HORIBA) — has obtained accreditation based on ISO/IEC 17025…

HORIBA announced European availability of the UP-100, a micro-volume in-line pH monitor which has uses in several applications and sectors including…

Nuneaton, 5th July, 2017. HORIBA MIRA – a world-leader in advanced engineering, research and product testing, a subsidiary of HORIBA, Ltd. – has…

At this year’s Automotive Testing Expo Europe (June 20 - 22 2017), engine exhaust analyzer experts, HORIBA and pioneering engineering provider HORIBA…

HORIBA presents new Raman spectroscope XploRa series at its Electrification corner & new dynamometers series DYNAS3 High Speed supports development of…

Modular on-board emissions measurement system to comply with latest emission testing regulation requirements. Software functions to streamline…

HORIBA, a leading supplier for emission measurement and automotive test systems, introduces its new and revolutionary STARS ENTERPRISE Lab Management…

New test systems to close the gap between road and laboratory: HORIBA will present its extensive portfolio of innovative Automotive Test Systems…

Opening Ceremony Held on May 17

HORIBA STEC, Co., Ltd. (hereafter HORIBA STEC) has completed construction of a new facility of its subsidiary HORIBA…

HORIBA Group recently delivered an order from the Ministry of the Environment of Japan (MOE Japan) for HORIBA’s PX-375 Continuous Particulate Monitor…

HORIBA sponsored a ‘Hackathon’ that brought together students from the University of Tokyo and the École Polytechnique to do computer programming and…

Set to become the new hub of its Process & Environmental business

HORIBA has extended its capability to go beyond its traditional semiconductor base to benefit world-leading High Altitude Atmospheric research into…

January, 2017 - HORIBA, Ltd. and Hitachi Zosen Corporation have jointly made a business proposal for the “Model Project for Improvement of Water…

HORIBA Jobin Yvon SAS Merges with its Subsidiary, HORIBA FRANCE SARL.

The New Company will be known as HORIBA FRANCE SAS.

HORIBA Jobin Yvon SAS, a…

SEC-Z500X Series

Becoming a demonstration base for emission measurement systems and advanced analytical instruments

Vehicle Emission Test Systems (VETS) are indispensable for realizing emission measurements on chassis dynamometers.

Since May 2016, Dr. Hiroshi Nakamura has held the position of President of HORIBA Europe GmbH.

New legal regulations, based on the growing demands made on emission testing, require the global comparability of exhaust certificates and prescribe…

HORIBA’s Automotive Test Systems (ATS) with the Emission Measurement Systems (EMS), Mechatronics (MCT) and Test Automation Systems (TAS) departments…

SPEX Forensics, an HORIBA Scientific company, just announced the launch of their new HandScope® LED (HS-LED-5F). Designed to overcome the major short…

This summer, HORIBA Automotive Test Systems (ATS) sold a two-wheel drive (2WD) VULCAN chassis dynamometer to Darmstadt University (Hochschule…

“By 2017, RDE tests will be a mandatory part of the type approval of light duty vehicles“, says Joel Danzer, European Product Manager Emission…

In the new and conveniently located brake test center, both companies will be concentrating their expertise as well as their testing technologies.

Darmstadt / Oberursel (Taunus), July 12, 2016 – At this year’s Automotive Testing Expo Europe in Stuttgart, HORIBA presented MEDAS (short for: Mobile…

HORIBA has won the 2016 Solar + Power PV Process Award

Aiming for creativity, high quality and speed in order to innovate manufacturing

With effect from May 1, 2016, Hiroshi Nakamura becomes new President of HORIBA Europe GmbH.

Growing challenges with regard to environmental policy have profoundly changed the demands made on vehicle and engine emissions measurement in the…

Acquisitions mean changes – a fact that both HORIBA and MIRA were aware of when they signed the contract in July 2015.

Technology and know-how all from one supplier at the Oberursel site

The 24 member technical department of HORIBA France ATS services 40 customers from different backgrounds; including car and engine makers, automotive…

As a leading system supplier, HORIBA is always dedicated to optimizing emissions testing methods to help OEMs comply with the stringent regulations.

Due to the Real Driving Emissions (RDE) tests decided on by the European Commission for 2017, vehicle manufacturers face new challenges. The primary…

Hematology Everywhere, For Everyone

“Pursuit of power and speed” will be the next cooperate competitiveness.

Our slogan "One step ahead" is the spirit of rugby that Masao Horiba loved.

Continuous particulate monitoring, also including ”HEAVY METALS” analysis in PM2.5. Combined beta-ray attenuation and X-ray fluorescence.

Dear Sirs and Madams

With great sadness, we have to inform you of Dr. Masao Horiba, our founder and Supreme Counsel, passed away peacefully in his…

HORIBA acquires UK based company MIRA Ltd. to expand vehicle development and testing business, and contribute to development of next-generation…

HORIBA, Ltd. merged its subsidiaries in Korea, Horiba Korea Ltd. (HKL) and Horiba Automotive Test Systems Ltd. (HAKR).

The two firms were the…

HORIBA ABX SAS, a French subsidiary and the core company in HORIBA’s medical business, completed construction of a new R&D laboratory on the premises…

To be in line with environmental conservation trends in Vietnam

The PG-300 series, a lineup of portable gas analyzers, won the German Design Award 2015, one of the most prestigious design awards in the world.

HORIBA is pleased to announce the company is releasing its new Ultimate ENDA-7000 Series of continuous emissions monitoring systems (CEMS). For over…

The Clinical Chemistry market is constantly evolving; adapting to it is permanent requirement. The Pentra 400 range continues to develop with one…

The PG-300 portable gas analyzer was awarded the iF product design award 2014 among 4615 product entries from 55 contributing countries. Established…

HORIBA aims to double production capability and shorten delivery time to one-third by its

new production methodology for the multi-products,…

The combined organization extends HORIBA’s global leadership position in the fluorescence spectroscopy market.

With 450 mm wafer production in view, measurement accuracy is doubled for the high temperature cleaning process

Body downsized by 40% enables…

Compact sulfur analyzer suitable for on-site applications released

Responding to the need for curbing sulfur-derived air pollutants

As we announced on March 29, 2012, we have participated in France photovoltaic research institute “Solar R&D Center Institut Photovoltaïque d’Il de…

HORIBA acquires Cameron's process analytical product line, demonstrating a commitment to building the future core business for our Process &…

Unique QC and training software to help standardise blood film review

The 2013 HORIBA Calendar, "A Longing for Wings" won the Excellent Calendar Award at the Gregor International Calendar Awards held in Stuttgart,…

HORIBA to Ensure More Reliable and Safe Pet Healthcare with Its New Blood Glucose Meter that is Fast, Accurate and Requires Only a Tiny Blood Sample

For expansion and acceleration of medical business in India

: Automatic Blood Cell Counter and CRP Analyzer

On April 10, 2012, HORIBA concluded a basic contract with the Beijing Center for Physical and Chemical Analysis (BCPCA), a state-owned research…

New Caterpillar production base in Tianjin, China, will be equipped with three heavy-duty test cells and one generator test system by HORIBA

HORIBA…

In January, 2012, HORIBA, Ltd. announced the restructuring of the U.S. subsidiaries, including the merger of 4 U.S. subsidiaries to HORIBA…

HORIBA International Corporation (Irvine-CA), the North and South American regional holding

company of HORIBA, merged its U.S. businesses into one…

Success in development of a new technology for electron microanalysis

-a innovative method for structural analysis-

Expanding control and analysis equipment specialist Horiba Instruments is aiming to boost sales of its specialist hand-held scientific range in Europe…

Sales at HORIBA Instruments are soaring, thanks to strong demand in solar energy, LED technology and the automotive sector.

The company saw turnover…

Mr. Atsushi Horiba, President & CEO of HORIBA, Ltd., signed the Letter of Commitment of the United Nations Global Compact (UNGC) and submitted it to…

Production of reagents for hematology analyzer to be newly undertaken

Existing plants to be consolidated into this core plant

Targeting 150 billion yen in net sales, operating income margin of 13% or more, and ROE of at least 11% in five years.

Production capacity of hematology reagents is to be doubled

Handle expansion in medical services driven by economic growth

For a stronger alliance between its Singaporean subsidiary and local sales agents and as a market research base

A new step in ASEAN business…

Industry-Academia Joint Development: Trace Heavy Metal Measurement Device Incorporating Diamond Electrodes

The PG-250 has been displayed recently on the national M-Net channel in South Africa. Envirocon instrumentation, HORIBA P&E representative in South…

Two France-based businesses of HORIBA Group achieved dramatic growth

Enabling the intravenous fluid production in the space

The Masao Horiba Awards was established in 2003 to promote research activities in the field of analysis and measurement technology by researchers…

HORIBA, Ltd. released the desktop-size nanoparticle analyzer “SZ-100” for nanomaterial particle size and surface potential measurement in Japan and…

On June 1, 2009, General Motors Corporation (GM), one of our customers, filed for Chapter 11 bankruptcy protection in the U.S. Based on current…

Production capacity increased threefold

To serve as the Group's logistics & stock hub, significantly contributing to cost reduction

The Biwako Plant…

HORIBA STEC, Co., Ltd. (President: Atsushi Horiba, Headquarters: 11-5, Hokotate-cho, Kamitoba, Minami-ku, Kyoto City, Kyoto, Japan) will release a…

Full-scale entry into Asia-centered markets aims at starting sales of domestic-made plasma emission spectrometry end point monitors to manufacturers…

World's Only Blood Cell Count/CRP Measuring Apparatus Full-Model Change “Microsemi LC-667CRP”

Thirty-sec faster measurement than conventional model …

Laboratory reagent plant of French subsidiary to start operation on 19 September. Doubling production capacity in the US and European markets. Aiming…

HORIBA Know-How Is in the Field of Precisely Measuring Air/Water Quality, and Technical Education

Joint Press Conference in Beijing on May 13, 2008

Yuki Hayashi of HORIBA Legal Affairs Department and one of Japan's women archers at the Beijing Olympics, placed eighth in the team competition.

On…

Encouraging award for outside researchers in the field of analysis and measurement technology

Yuki Hayashi, a HORIBARIAN* working at the HORIBA headquarters in Kyoto will participate in the upcoming Beijing 2008 Olympics. She will take part in…

On 19th October 2007, HORIBA Group President, Mr.Atsushi Horiba, attended the HORIBA Outstanding Distributor Award Ceremony in China, and presented…

Let's focus on coral reefs, ocean forests, and to think about the global environment.

Advocating initiatives by the Ministry of Environment to…

With an expanded range of Engine, Driveline and Emissions Testing products and services, HORIBA presented a show theme of "Total Solutions Provider"…

HORIBA, Ltd. has developed a new particle size distribution analyzer, model LA-950V2, which uses a laser beam to analyze particle size. The new model…

Complete analysis of tiny samples (12 mL) in 80 seconds without preprocessing. No need for manual resetting for different animals: setting cards…